From Oil to Wellness: The Massive GCC Investment in Medical Tourism

InternationalBusiness

Feb 17, 2026

GCC countries are shifting from oil to healthcare, investing in hospitals, AI, and medical visas to grow medical and wellness tourism.

The Gulf Cooperation Council (GCC) countries are rapidly shifting focus from oil to healthcare, investing heavily in medical tourism to diversify their economies. Key players like Saudi Arabia, the UAE, Qatar, and Oman are building world-class healthcare facilities under initiatives like Saudi Vision 2030 and UAE Vision 2031. Here’s what you need to know:

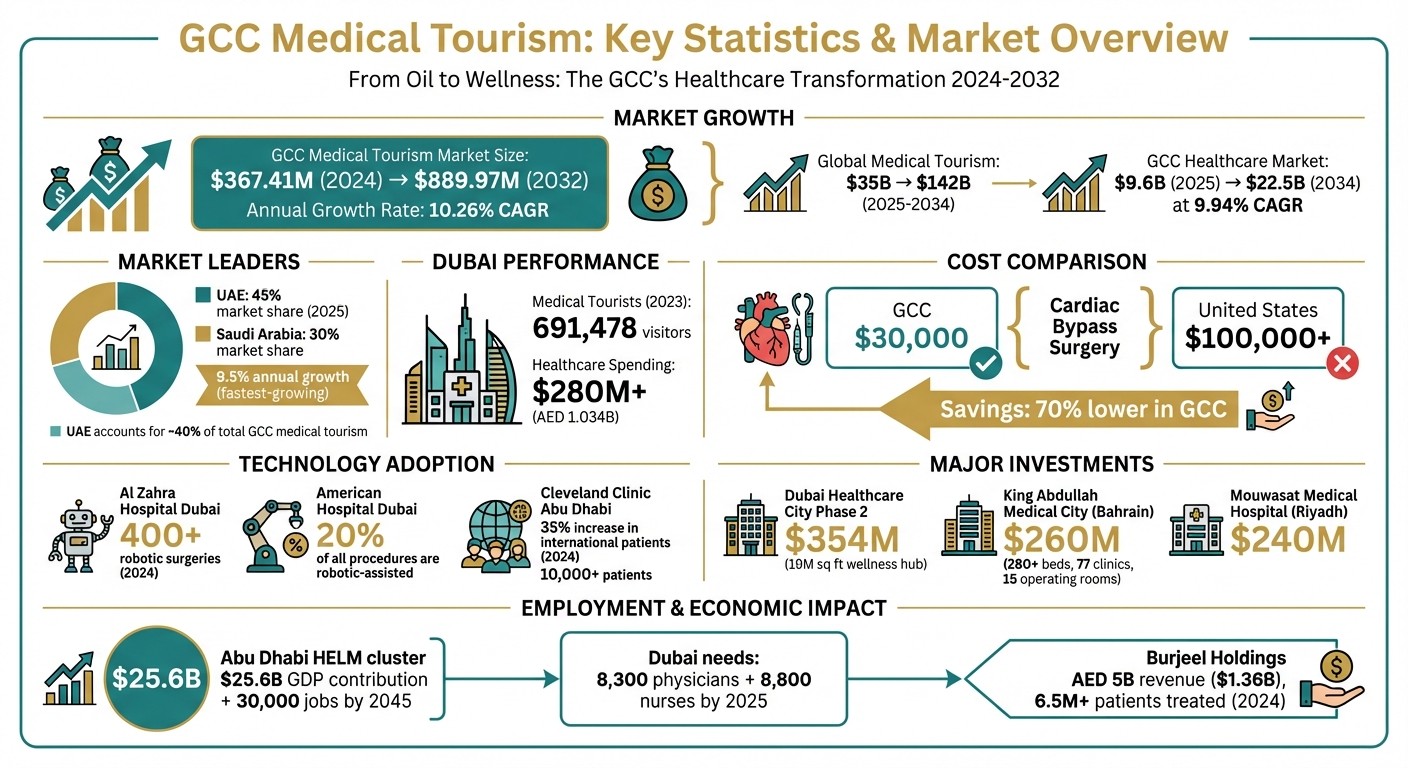

Market Growth: The GCC medical tourism market is projected to grow from $367.41 million in 2024 to $889.97 million by 2032, with a yearly growth rate of 10.26%.

Top Players: The UAE leads the sector, holding 45% of the market as of 2025, while Saudi Arabia is the fastest-growing market with a 9.5% annual growth rate.

Why GCC? Patients are drawn by shorter wait times, Western-trained professionals, advanced technology (e.g., robotic surgeries), and competitive pricing (e.g., cardiac bypass surgery costs $30,000 in the GCC vs. $100,000+ in the US).

Infrastructure Investments: Mega-projects like Dubai Healthcare City, SEHA Virtual Hospital in Saudi Arabia, and Bahrain’s King Abdullah Bin Abdulaziz Medical City are transforming the region into a global healthcare hub.

Digital Advancements: Platforms like SEHA Virtual Hospital and AI-driven tools are improving patient access and care delivery.

The GCC is positioning itself as a global leader in medical and wellness tourism, leveraging its strategic location and cutting-edge healthcare technologies. However, challenges like aligning insurance policies and building local talent remain critical for sustained growth.

GCC Medical Tourism Market Growth and Key Statistics 2024-2032

Medical Tourism Growth in the GCC

Market Size and Growth Forecasts

The medical tourism sector in the GCC is on a fast track, with the market estimated at $9.6 billion in 2025 and expected to hit $22.5 billion by 2034. This reflects an impressive compound annual growth rate (CAGR) of 9.94%. On a global scale, the medical tourism market is also expanding, projected to grow from $35 billion to $142 billion within the same timeframe.

Among GCC nations, the UAE leads the pack, holding a 45% market share as of 2025. Meanwhile, Saudi Arabia is making waves as the fastest-growing market, with a forecasted CAGR of 9.5% through 2032. Dubai’s performance in 2023 underscores this growth - 691,478 medical tourists visited the city, contributing over $280 million in healthcare spending. This steady rise highlights the growing demand for healthcare services in the region and the appeal of its medical offerings.

Why Patients Choose GCC Medical Tourism

Several factors are drawing international patients to GCC countries for medical care. One of the biggest attractions is shorter waiting times, especially compared to public healthcare systems in Western countries, where long delays for specialized treatments are common. Additionally, the GCC boasts Western-trained medical professionals, JCI-accredited hospitals, and competitive pricing. For example, a cardiac bypass surgery in the GCC costs around $30,000, significantly lower than the $100,000+ price tag in the United States.

The region’s adoption of advanced medical technology adds another layer of appeal. At Al Zahra Hospital Dubai, over 400 robotic surgeries were performed across various specialties in 2024. Similarly, American Hospital Dubai reports that robotic-assisted surgeries now make up 20% of all procedures, offering minimally invasive options that lead to quicker recovery times. The GCC’s strategic location, positioned between Europe, Asia, and Africa, further enhances its accessibility for international patients seeking top-tier care.

Major Healthcare Infrastructure Projects

UAE Healthcare Developments

The UAE is making bold moves in healthcare infrastructure, aligning with the Gulf Cooperation Council's (GCC) focus on wellness investments. One standout project is Dubai Healthcare City (DHCC), which announced a $354 million (AED 1.3 billion) development plan in October 2025. Phase 2 of this initiative will bring a 19 million square foot wellness hub to Al Jadaf, combining clinical care with sustainable wellness living.

Cleveland Clinic Abu Dhabi has seen a 35% increase in international patient visits in 2024, with over 10,000 patients seeking specialized care. The facility continues to innovate with AI-integrated linear accelerators at the Fatima bint Mubarak Center, enhancing radiation therapy. In early 2025, the clinic tested AI-generated "virtual human twin" avatars for breast cancer screening, demonstrating its commitment to cutting-edge technologies.

Meanwhile, Burjeel Holdings invested $5.4 million (AED 20 million) in late 2024 to establish nine primary-care clinics, anticipating 300,000 outpatient visits annually. The group has also achieved significant milestones, including the UAE's first pediatric liver transplant and the region's first in-utero spina bifida repair. Additionally, Mediclinic City Hospital earned its designation as a Center of Excellence in Surgical Proctology in August 2025, while DHCC began construction in mid-2024 on Dubai's first integrated gastroenterology hospital.

These advancements are positioning the UAE as a leader in healthcare transformation across the region.

Saudi Arabia's Vision 2030 Healthcare Initiatives

Saudi Arabia is also making strides in healthcare as part of its Vision 2030 plan, with a focus on digital integration and specialized care. The SEHA Virtual Hospital, the largest of its kind globally, connects over 150 hospitals and provides more than 30 specialized health services, including remote surgeries and virtual consultations. This initiative is part of the kingdom's goal to implement unified digital medical records for its entire population.

On the construction front, the Mouwasat Medical Hospital in Riyadh represents a $240 million investment in specialized care. At the same time, the King Faisal Specialist Hospital & Research Center has achieved nearly 1,195 robotic-assisted procedures as of 2023. These include groundbreaking robotic-assisted heart transplants and artificial heart pump implantations, showcasing Saudi Arabia's commitment to advanced medical technologies.

Qatar and Bahrain Medical Centers

Qatar and Bahrain are also stepping up with ambitious healthcare projects. In Qatar, Sidra Medicine has become a hub for specialized care, integrating genomics research with clinical services to create personalized treatments for rare diseases and cancer. This effort aligns with Qatar's $2.5 billion National AI Strategy, which aims to position the country as a leader in the digital economy by 2030, with healthcare innovation at its core.

In Bahrain, the King Abdullah Bin Abdulaziz Medical City, a $260 million collaboration between Saudi Arabia and Bahrain, is set to transform the nation's healthcare landscape. Scheduled for Phase 1 completion by the end of 2026, the facility will include over 280 beds, 77 outpatient clinics, and 15 operating rooms. It will also feature research centers dedicated to diabetes and obesity. According to the Supreme Council for Health, the project is expected to "create more than 1,000 job opportunities" and establish Bahrain as a leading destination for healthcare in the region.

Government Policies and Global Partnerships

Medical Visa Programs

Governments in the GCC region are simplifying visa processes to attract international patients. Both the UAE and Saudi Arabia have introduced specialized medical visas that allow extended stays, specifically designed for post-surgical recovery. These visas make it easier for patients and their families to stay in the country during treatment.

Dubai has taken a leading role with its centralized medical tourism platforms that handle everything from visa applications to treatment bookings. In 2022, the city welcomed 674,000 medical tourists, showcasing the success of these streamlined entry procedures. Adding to this, the Dubai Health Authority launched the 'Dubai in One Day' medical tourism package in June 2024. This initiative enables international visitors to schedule medical procedures quickly while enjoying access to tourism amenities and simplified entry processes.

Abu Dhabi, on the other hand, has focused on maintaining high-quality standards. Starting in March 2025, its updated Medical Tourism Standard mandates healthcare facilities to achieve at least a "3 Diamonds" rating under the Muashir ranking system and secure dedicated medical tourism accreditation within 18 months. Additionally, all facilities must integrate with Malaffi, Abu Dhabi's Health Information Exchange system, to ensure smooth data sharing and improved patient safety. These efforts have helped Abu Dhabi earn the title of the 9th best medical tourism destination globally and the top spot within the GCC.

These visa reforms and quality measures have paved the way for strategic partnerships that further enhance patient access and experience.

Healthcare Provider Partnerships and Marketing

With streamlined visa processes in place, healthcare providers across the GCC are forming global alliances to expand their reach. For example, Thumbay Group has partnered with Ethiopian Airlines to offer affordable healthcare packages to patients from over 175 countries. This collaboration leverages the airline's extensive African network, creating direct links between patients and UAE medical facilities.

In October 2025, Abu Dhabi’s M42 group teamed up with the Medical Tourism Association (MTA) and Mastercard to launch the "Better by MTA" platform. This initiative connects patients to top-tier institutions like Healthpoint and the Imperial College London Diabetes & Endocrine Centre, while also simplifying complex cross-currency payment systems.

Expanding its footprint in Africa, American Hospital Dubai opened a medical tourism representative office in Lagos, Nigeria in 2024. This is part of a larger plan to establish 30 such offices across Africa and Eastern Europe. These centers assist patients with travel arrangements, visa support, and direct access to care. Similarly, in April 2025, Healthtrip partnered with Satguru Travel Group to connect African patients with leading medical centers in the UAE and Saudi Arabia, utilizing air routes operated by Emirates and Etihad Airways.

These collaborations highlight how GCC nations are focusing on emerging markets like Africa and Eastern Europe to attract growing numbers of outbound medical travelers. The UAE alone accounts for approximately 40% of the GCC medical tourism market, followed by Saudi Arabia at 30%, driven by these strategic efforts and policy changes.

Economic Impact and Digital Tools

Revenue and Employment Effects

As the Gulf region shifts its focus from oil to more diversified industries, sectors like medical tourism and digital innovation are becoming pivotal. Medical tourism, in particular, is reshaping the GCC economy while reducing its reliance on oil. In 2023, Dubai alone attracted 691,478 medical tourists, leading to over $280 million (AED 1.034 billion) in healthcare spending. The broader GCC medical tourism market was valued at $371.5 million in 2025, with projections indicating it could reach $889.97 million by 2032, growing at a yearly rate of between 9.4% and 10.26%.

Wellness tourism is growing even faster. In Saudi Arabia, this market is valued at $19.8 billion, with wellness tourism itself expanding at an annual rate of 66% and an overall growth rate of 17% per year. This surge stems from the sector's division into "Hardcare" (advanced medical procedures and surgeries) and "Softcare" (preventive care, nutrition, and longevity programs), which opens up diverse revenue opportunities beyond conventional medical services.

The employment impact of these changes is equally striking. Abu Dhabi’s HELM cluster, for instance, is expected to contribute $25.6 billion to the emirate's GDP and generate 30,000 jobs by 2045. Meanwhile, Dubai anticipates needing an additional 8,300 physicians and 8,800 nurses by 2025 to meet rising healthcare demands. In 2024, Burjeel Holdings reported a 10.5% revenue increase, reaching AED 5 billion ($1.36 billion), after treating over 6.5 million patients across its network.

These financial and employment gains underscore how diversification and innovation are driving the region's economic transformation.

Digital Platforms for Healthcare Management

The success of these industries is increasingly tied to digital tools, which are streamlining operations in GCC healthcare facilities. The UAE, for example, is home to 257 health-tech startups, including platforms like Okadoc, which has raised $123 million, and Bayzat, which has secured $31 million in funding.

Generative AI is another game-changer, with a potential economic impact of $23.5 billion annually across the GCC by 2030. Saudi Arabia’s SEHA Virtual Hospital (SVH), launched in 2022, is now the world’s largest virtual hospital. It connects over 150 hospitals and offers more than 30 specialized telemedicine services. This system allows international patients to access pre-arrival consultations and post-treatment follow-ups remotely.

In the UAE, platforms like Med42 use AI to automate clinical documentation and streamline insurance claims, while AI-powered chatbots provide 24/7 multilingual communication for patients. The widespread availability of 5G - covering over 90% of the GCC - supports these advanced digital solutions.

Conclusion

The GCC is making significant strides in reducing its reliance on oil, with medical tourism expected to reach $889.97 million by 2032 and wellness tourism growing at an annual rate of 17%. The region's focus on large-scale projects and the rapid integration of AI-driven diagnostics and robotic-assisted procedures reflects a long-term vision rather than a pursuit of short-term gains.

Beyond promising forecasts, the GCC is also advancing in clinical achievements. For instance, HELM Abu Dhabi is projected to contribute $25.6 billion to GDP by 2045, while Saudi Arabia recorded 2,091 organ transplants in 2023 alone. By combining cutting-edge digital platforms, specialized centers of excellence, and a focus on longevity-focused care, the GCC offers a patient experience that stands apart from more traditional, budget-focused medical tourism destinations.

However, sustaining this momentum requires addressing key challenges. These include aligning insurance policies, maintaining competitive pricing, and developing local healthcare talent to reduce reliance on expatriate professionals. Tackling these areas will help turn potential obstacles into opportunities for long-term growth.

To keep progressing, the region must focus on cohesive marketing, regulatory updates, and continuous investment in both physical and digital infrastructure. Together, these efforts will strengthen the GCC's commitment to reshaping healthcare.

This shift from oil to wellness signifies more than just economic diversification - it’s about redefining the region’s future. With advanced technologies and world-class clinical care, the GCC is positioning itself as a leader in global medical tourism. Through strategic investments, the region is on track to become both a regional healthcare powerhouse and a global destination for innovative medical and wellness experiences.

FAQs

What is driving the rapid growth of medical tourism in the GCC region?

The Gulf Cooperation Council (GCC) region has seen a surge in medical tourism, driven by several important factors.

First, massive investments in healthcare infrastructure have transformed the region into a hub for advanced medical treatments. State-of-the-art facilities now offer specialized services in areas like cardiology, oncology, fertility, and cosmetic surgery. These cutting-edge options attract patients from across the globe who are seeking top-tier care.

Second, government initiatives such as Saudi Vision 2030 and the UAE’s Vision 2031 have made medical tourism a priority. These programs aim to diversify the economy by promoting partnerships between public and private sectors, streamlining regulations, and supporting internationally accredited healthcare providers. This has helped establish trust and credibility on a global scale.

Lastly, the GCC provides affordable and efficient healthcare compared to many Western nations. Patients benefit from shorter waiting times, a convenient location, modern facilities, and wellness services - all of which make the region an attractive destination for high-quality yet cost-effective medical care.

How are GCC countries providing high-quality and affordable healthcare services for medical tourists?

GCC countries are focusing heavily on creating top-tier healthcare infrastructure and establishing internationally accredited medical facilities to attract medical tourists. By investing in advanced hospitals and clinics staffed with highly skilled professionals - many of whom have received international training - they ensure an exceptional level of care.

To make healthcare more affordable, these countries rely on government-backed programs and public-private collaborations to control costs while increasing access to services. On top of that, the region offers shorter waiting times, specialized treatments, and pricing that’s often more competitive than in Western nations. These combined efforts are turning the GCC into a go-to destination for dependable and cost-efficient medical tourism.

What obstacles do GCC countries face in becoming leaders in medical tourism?

GCC countries face a range of challenges in establishing themselves as top players in the medical tourism sector. One major obstacle is creating and sustaining high-quality healthcare infrastructure that meets international accreditation standards. This demands hefty investments and constant advancements to deliver top-tier care.

Another pressing issue is streamlining regulatory and visa procedures to make it easier for international patients to access healthcare services across borders. At the same time, ensuring uniform quality and safety standards across the rapidly expanding network of healthcare facilities is critical for earning global trust.

The region also faces stiff competition from established medical tourism hubs like Singapore and India, which boast strong reputations and well-developed systems. To address these challenges, GCC nations need to prioritize strategic branding, reform regulations, and provide outstanding patient experiences that cater to a variety of cultural and language preferences.