Bahrain as a Fintech Gateway: Why Startups are Choosing Manama over Dubai

InternationalBusiness

Feb 17, 2026

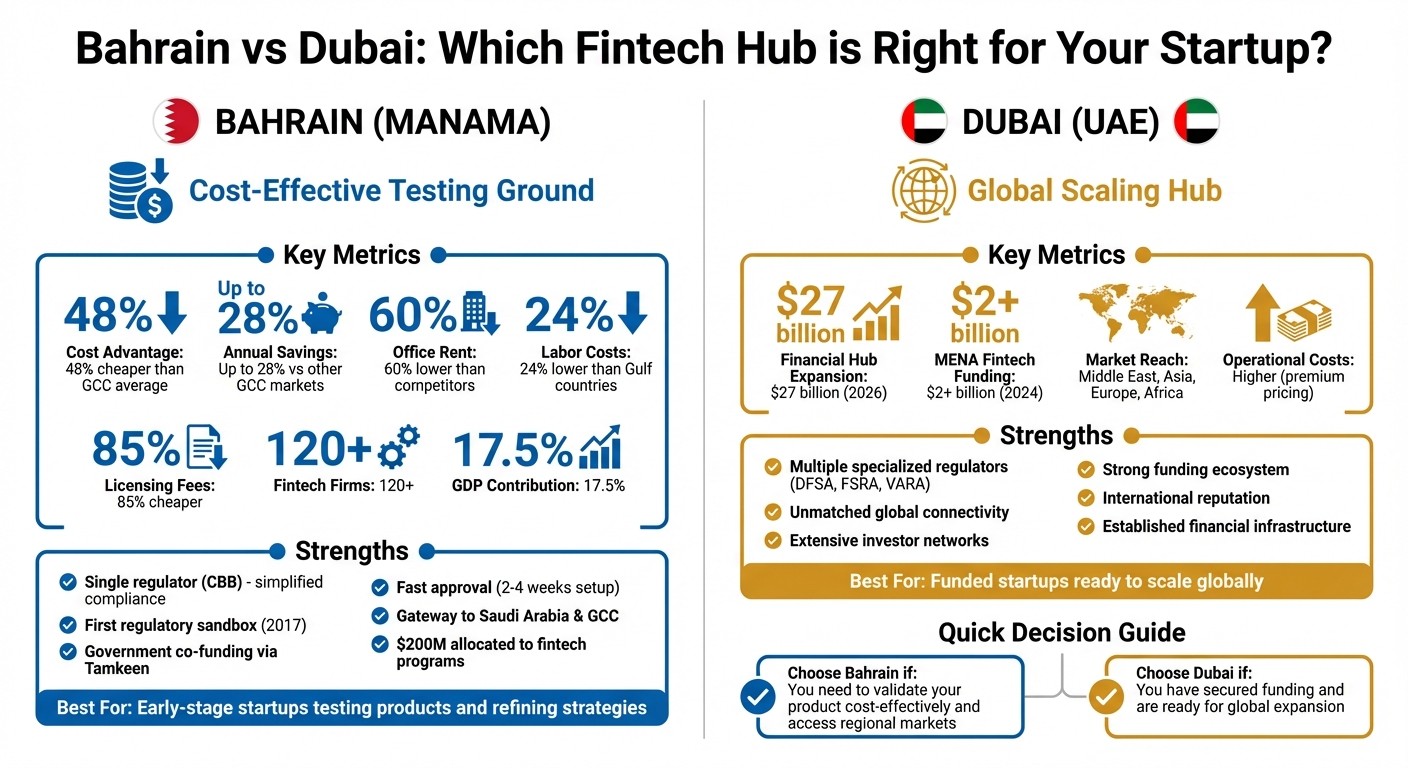

Bahrain offers lower costs, a single regulator, and strong government support for fintech testing, while Dubai suits startups ready to scale globally.

Looking to expand your fintech startup in the Gulf? Here’s the quick takeaway: Bahrain is emerging as a cost-effective launchpad, while Dubai remains the region's global scaling hub.

Bahrain offers lower costs (up to 48% cheaper than GCC averages), a simplified single-regulator system, and strong government support. It's perfect for startups testing products and refining strategies.

Dubai provides unmatched global reach, extensive investor networks, and a well-established financial ecosystem. However, its high operational costs may pose challenges for early-stage businesses.

Key Stats:

Bahrain fintech accounts for 17.5% of GDP with 120+ firms.

Startups in Bahrain save up to 28% annually compared to other GCC markets.

Dubai announced a $27 billion expansion of its financial hub in 2026.

Quick Comparison:

Feature | Bahrain (Manama) | Dubai (UAE) |

|---|---|---|

Regulation | Single regulator (CBB), simplified | |

Costs | 48% cheaper than GCC average | Higher operational expenses |

Market Access | Gateway to Saudi Arabia and GCC | Global connectivity |

Startup Support | Government co-funding, fast approval | Strong funding networks |

Bottom Line: Bahrain is ideal for startups focused on cost-efficient regional growth, while Dubai suits those ready to scale globally. Your choice depends on your priorities - testing ideas or expanding reach.

Bahrain vs Dubai Fintech Hub Comparison: Costs, Regulation, and Market Access

1. Manama (Bahrain)

Regulatory Environment

Bahrain operates under a single-regulator model, with the Central Bank of Bahrain (CBB) overseeing all financial activities. This approach simplifies compliance by avoiding the need to navigate multiple regulatory bodies.

In June 2017, the CBB launched the region's first regulatory sandbox, offering startups a 12-month testing period with potential regulatory flexibility. The application fee is only BD 100 (about $265). Bahrain also led the way in open banking regulations, introducing formal rules in December 2018 - the first country in the MENA region to do so. In 2019, the CBB took another step forward by issuing its Crypto-Assets Module, providing clear guidelines for digital asset platforms well ahead of many regional competitors.

Rain, the region's first regulated crypto trading platform, obtained its CBB license in 2019. By January 2022, the platform had raised $110 million in Series B funding and processed over $1.9 billion in transactions. Another success story is Tarabut Gateway, an open banking platform that graduated from the CBB sandbox. In May 2023, it secured $32 million in Series A funding to expand into Saudi Arabia.

These regulatory advancements, paired with Bahrain's cost advantages, make it a compelling destination for fintech innovation.

Cost Advantages

Bahrain offers significant cost savings for businesses. Compared to the GCC average, operating a financial services tech hub in Bahrain is 48% more affordable. Office rents are up to 60% lower than in competing financial centers, and annual business and licensing fees are 85% cheaper. Additionally, technical labor costs are 24% lower than in other Gulf countries.

These cost benefits have attracted major players. In July 2025, Citi established its Global Tech Hub in Bahrain, planning to hire 1,000 Bahraini coders due to the country's cost-effectiveness and skilled workforce. Similarly, JP Morgan launched a Global Technology Centre, creating 200 high-skilled jobs while taking advantage of Bahrain's lower operational costs.

This combination of affordability and expertise is positioning Bahrain as a standout option for fintech operations in the region.

Government Support

Bahrain's government actively supports fintech growth through initiatives like Tamkeen, the national Labor Fund, which helps startups with hiring, training, and technology adoption. A total of $200 million has been allocated to fintech programs. The Bahrain FinTech Bay (BFB) acts as a central hub, connecting startups with established financial institutions and investors.

In 2025, BFB collaborated with the National Bank of Bahrain (NBB) and BENEFIT to test a Google Cloud Universal Ledger pilot, enabling instant tokenized BHD payments for corporations like Alba and Bapco Energies. The CBB also operates FinHub973, a digital lab for fintechs to experiment with APIs and prototype solutions under regulatory oversight. In November 2022, the CBB issued an operating license to Fintech Galaxy, making it the first central-bank-regulated open finance platform in the MENA region.

These initiatives enhance Bahrain's appeal by combining government support with a business-friendly environment.

Access to Markets

Bahrain acts as a launchpad for startups aiming to expand across the region. Formal agreements with Saudi Arabia (via Jeel and Riyad Bank) and Qatar (through the Qatar Financial Centre) allow startups to transition smoothly between sandboxes. This cross-border collaboration provides a clear pathway from local testing to regional scaling.

Looking ahead, the CBB plans to introduce a digital dinar by 2026 to facilitate faster cross-border payments. Additionally, the regulator is working on an AI regulatory framework to address governance in AI-driven financial services. By 2025, Bahrain hosted over 120 fintech companies, more than doubling its 2018 figures.

These efforts underscore Bahrain's role as a gateway for fintech companies seeking regional growth opportunities.

2. Dubai (UAE)

While Bahrain's fintech model thrives on flexibility and cost-efficiency, Dubai brings a different set of strengths through its established global platform.

Regulatory Environment

Dubai's regulatory framework for fintech involves specialized agencies like VARA (Virtual Assets Regulatory Authority) for digital assets. This sector-specific approach, while addressing niche needs, introduces a level of complexity not found in Bahrain's single-regulator system.

This specialized structure is particularly attractive to companies focusing on areas such as cryptocurrencies. On the other hand, Bahrain's more streamlined regulatory model allows startups to test and refine their operations quickly before scaling to larger markets. This difference in approach underscores the contrast in how each ecosystem supports innovation and growth.

Cost Advantages

Dubai's position as a global financial hub comes with higher operational costs. The city offers access to international markets through platforms like the Dubai Financial Market and Nasdaq Dubai, but startups face significant expenses for office space, licensing, and labor. These premium costs stand in stark contrast to Bahrain, which enjoys a 48% cost advantage over the GCC average.

While Dubai offers unparalleled market access, its cost structure may pose challenges for smaller startups or those with limited budgets.

Access to Markets

Dubai's location and infrastructure give it a unique edge in market connectivity. Positioned strategically between Europe, Asia, and Africa, Dubai serves as the UAE's commercial capital and a central hub for trade and finance in the Middle East. Its infrastructure is designed to support international business, making it a key player in global commerce.

In January 2026, Dubai announced a $27 billion expansion of its financial hub (DIFC), reinforcing its role as a global financial leader. The city also boasts a strong funding ecosystem, with Dubai-based funds driving a significant share of Gulf fintech investments in 2024. Total MENA fintech funding exceeded $2 billion, offering startups access to broader liquidity and faster capital.

Strengths and Weaknesses

Looking at the profiles of Manama and Dubai, it’s clear that both cities offer distinct advantages depending on a startup's priorities. Here’s a closer look at how these two hubs stack up against each other:

Feature | Manama (Bahrain) | Dubai (UAE) |

|---|---|---|

Regulatory Framework | Operates under a single regulator (CBB); introduced the region's first regulatory sandbox in June 2017; offers a streamlined approval process | Features multiple specialized regulators (e.g., DFSA, FSRA, VARA), which can make navigation more complex |

Costs | Around 48% more affordable than the GCC average; labor costs are up to 24% lower, and office rentals can be up to 60% cheaper | Higher costs for office space, licensing, and talent |

Accessibility | Smaller market, ideal for initial product testing; cross-border connections to Saudi Arabia and Qatar through formal agreements (MoUs) | A major international hub with extensive market reach |

Startup Support | Easy access to decision-makers; Tamkeen provides co-funding for hiring and training; company setup takes just 2–4 weeks | Well-established startup ecosystem backed by strong funding networks |

Recognition | Limited global visibility despite strong regulatory initiatives | Recognized as a global financial hub with a strong international reputation |

These differences highlight how each city caters to startups in unique ways, influencing the strategies founders might adopt.

Manama’s biggest challenge is its smaller market size and relatively low international recognition. On the flip side, Dubai’s main drawback is its high operational costs, which demand significantly more capital from startups.

For startups, Bahrain shines as a "testbed" where they can refine products and strategies quickly before scaling across the region. Dubai, with its global reach, offers broader opportunities but requires a higher financial commitment from the outset. These trade-offs play a critical role in shaping expansion plans within the Gulf region.

Conclusion

When deciding between Manama and Dubai, the choice boils down to priorities: cost-effective testing or global scaling. Each city offers a unique pathway tailored to different stages of a fintech startup's journey.

Manama, Bahrain, stands out as a cost-efficient testing ground. With a 28% annual cost advantage and direct access to the Central Bank of Bahrain (CBB), fintech founders can quickly transition from concept to live product. For startups aiming to validate regulated use cases without breaking the bank, Bahrain provides an agile ecosystem supported by initiatives like Tamkeen's co-funding programs. Success stories from the region highlight Bahrain's commitment to fostering fintech innovation. Its strategic location also offers a gateway to Saudi Arabia and the broader Gulf market, making it an attractive choice for startups focused on regional expansion.

For early-stage fintechs, Bahrain delivers the perfect environment to test and refine their models.

On the other hand, Dubai is the go-to destination for startups ready to scale globally. With its extensive investor networks and international reputation, Dubai offers unparalleled market access and visibility. However, this comes with higher operational costs, making it best suited for ventures that have already validated their models and secured significant funding. Dubai's ecosystem is ideal for those seeking to connect with global capital and expand their reach on a larger scale.

For investors, Bahrain's CBB ensures a high standard of compliance and regulatory integrity, making it a trusted launchpad for fintechs aiming to establish credibility before expanding across the region. Both cities bring distinct advantages to the table, offering startups the opportunity to align their strategies with specific goals - whether that's minimizing costs, testing innovative solutions, or tapping into expansive markets. Ultimately, the decision hinges on balancing cost efficiency with market reach to carve out a successful path in the Gulf's fintech landscape.

FAQs

Why is Bahrain a more cost-effective choice for fintech startups compared to Dubai?

Bahrain has carved out a reputation as a wallet-friendly destination for fintech startups, thanks to its remarkably low operating costs. In fact, running a business in Bahrain can be up to 48% cheaper than in other GCC countries like Dubai. A big chunk of these savings comes from office rentals, which are up to 60% less expensive, and business and licensing fees, which can be slashed by as much as 85%.

But that's not all. Labor costs in Bahrain are about 24% lower than the GCC average, giving startups access to skilled talent without breaking the bank. When you pair these cost advantages with Bahrain’s pro-business regulatory framework and government-backed initiatives, it’s clear why the country is becoming a magnet for fintech startups looking to expand in the Gulf region.

What makes Bahrain's single-regulator system advantageous for fintech startups?

Bahrain has taken a forward-thinking approach to fintech by adopting a single-regulator system. This setup simplifies the approval and compliance process, cutting through red tape and helping startups enter the market faster. Instead of getting bogged down by complicated regulations, companies can focus their energy on developing new technologies and solutions.

To further support fintech innovation, Bahrain has initiatives like the Fintech & Innovation Unit and the Regulatory Sandbox. These programs offer a safe space to test emerging technologies, ensuring they meet regulatory standards without unnecessary delays. This streamlined framework not only shortens the path to market but also builds confidence among investors, positioning Bahrain as a top choice for fintech entrepreneurs.

How does government support drive Bahrain's growth as a fintech hub?

Bahrain’s journey to becoming a fintech hub owes much to strong government backing, which has paved the way for innovation and expansion. At the heart of this support is the Central Bank of Bahrain (CBB), which has spearheaded initiatives like the Regulatory Sandbox. This program provides startups with a safe space to experiment with new technologies before full-scale implementation. Additionally, the CBB has introduced forward-thinking regulations for areas like crowdfunding and digital financial services, ensuring a regulatory environment that encourages growth without stifling creativity.

Beyond regulatory support, Bahrain’s government actively invests in building a robust fintech ecosystem. Through initiatives such as partnerships, policy updates, and infrastructure enhancements, the country has created fertile ground for startups to thrive. A standout example is the acquisition of Bahrain FinTech Bay, which has transformed into a bustling hub for innovation, now supporting more than 100 startups. This strategic approach offers startups not only regulatory certainty but also access to critical resources and opportunities to expand into Gulf markets. These measures make Bahrain an appealing choice for fintech companies, whether they’re homegrown or looking to establish a presence in the region.